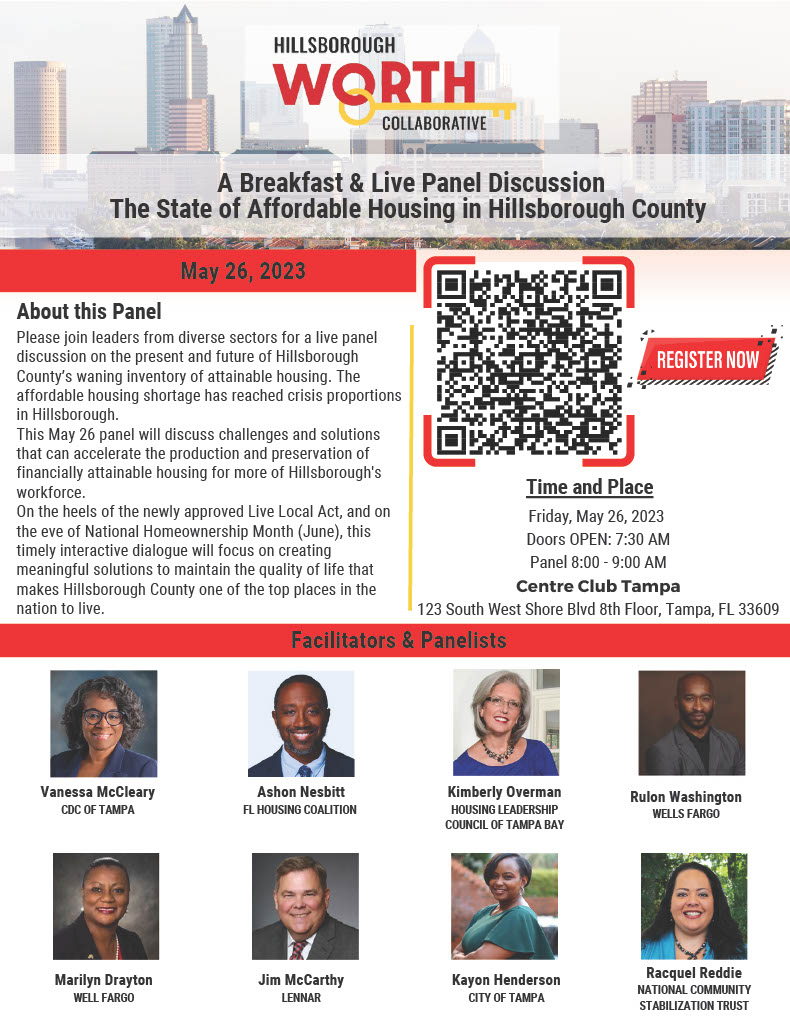

Tiffany Moore (above) was one of many local business owners who were approved for a PPP loan last year. Her firm – Moore Eventful Event Hall – was shuttered for months and is still operating at half its pre-COVID capacity.

The U.S. Small Business Administration opened a new round of Paycheck Protection Program (PPP) funding this January, and St. Petersburg’s One Community team is gearing up to help more African Americans secure this unique forgivable loan over the next two months.

Official data suggest that African Americans won a sizable share of the half a billion dollars in federal Paycheck Protection Program (PPP) Loans that went to St. Petersburg-based organizations in Round 1 of the program, which closed its application window in August 2020.

But the data also show black-owned firms and black-led non-profits receiving less than their representative share.

Across all race and ethnic groups, applicants in St. Petersburg won 6,400 PPP Loans in Round 1 (5,735 in the smaller category (less than $150,000) and 679 of the larger loans available (ranging up to $10 million).

PPP Loans in St. Petersburg in 2020

| Loan Size | # Loans | $Loaned | Avg Loan |

| Less than $150,000 | 5,735 | $166,340,581 | $29,004 |

| $150,000 to $10 million | 679 | $378,475,000* | $557,401 |

| TOTALS: | 6,414 | $544,815,581 |

It’s impossible to know precisely how much went to black-owned firms, since the SBA doesn’t require applicants to report their race or ethnicity.

But several data points suggest that African Americans in St. Pete held their own in the bum-rush for PPP dollars in the spring and summer of 2020 as businesses struggled through the COVID shutdown.

For one, the SBA database of loans approved through the end of 2020 shows 957 approved PPP loans totaling $62.1 million in South St. Petersburg zip codes, where 80% of the city’s African American population resides (33712, 33711 and 33705).

It’s a certainty that many of those loans went to white-owned firms, but anecdotal evidence suggests that African Americans were amply represented in the total.

Over two dozen One Community affiliated businesses (all black-owned) have reported being approved for PPP Loans. Plus, One Community Business Navigators helped nearly 60 African American entrepreneurs apply for and secure loans in Round 1 of the program.

Several other local development organizations also provided hands-on help to black-owned firms pursuing PPP funds, including Pinellas County Urban League and Grow Smarter.

Lolita Dash-Pitts was one of six One Community Business Navigators working with entrepreneurs to secure COVID relief dollars. She was able to secure a PPP loan for her own company – ATILOL Consulting Solutions – and helped 30 businesses to prepare PPP application documents. Of those, several were denied and a dozen decided not to complete their submissions. At least 8 of the businesses she advised were approved for a PPP loan.

Some business owners handled the process on their own, such as Tiffany Moore of Moore Eventful Event Hall. “I had all my paperwork in order, which made it easy for me to file the PPP application myself.” She was approved for Round 1 and is evaluating the new round of PPP funding.

Loans were smaller, on average, for applicants in South St. Pete zip codes; the area accounted for 22% of PPP loans of less than $1,000 and for 20% of loans ranging from $1,000 to $1,999 (versus only 10% of loans over $150,000).

But Development Leaders Say More Black-Owned Firms Should Apply

In all, the One Community team helped 270 black-owned businesses to secure COVID relief business loans and grants, but PPP was the smallest category of awards won.

Dash-Pitts says, “We have a lot of work to do to convince and support more community businesses to complete the PPP Round 2 process.”

According to her, the top three reasons businesses failed to complete the PPP application were 1) distrust that the loans would be forgiven, 2) lack of financial documentation , and 3) misperceptions about PPP requirements.

Many local entrepreneurs were unaware that sole proprietorships and independent contractors were also eligible for PPP loans, as were non-profit organizations, including churches.

The Good News; More Businesses Will be Eligible This Time

Round 2 of the PPP program opened on January 11, 2021, and One Community is helping community businesses to overcome their hurdles in time to submit Round 2 PPP applications by the March 31st deadline.

“Lack of financial documentation was a chief hurdle for too many community businesses last time, but much less so in this go round,” says Gypsy Gallardo, CEO of the One Community Plan and incoming Chair of Grow Smarter, the city’s economic equity strategy.

“One Community partners helped several hundred businesses to get their financial documents in place over the past year. That means that many more African American entrepreneurs and non-profits will be ready to take advantage of the PPP Round 2 program.”

The One Community team is once again teaming up with the Foundation for a Healthy St. Petersburg, the Florida SBDC, City Urban Affairs division, and others to steer entrepreneurs through the process.

Community partners will host several information sessions on how to secure PPP Round 1 and Round 2 loans.

A first webinar will be on Sunday, January 31st, specifically for childcare providers, beauty salons and barbershops that were grantees under the One Community Microgrant Program last year. Dash-Pitts is teaming up with Faye Watson, President of Up Empowerment Consulting and Training, along with Flora Jackson, Vice President of Business Solutions for Grow Financial Federal Credit Union, to host the “How To” session.

A second One Community webinar takes places on Tuesday, February 9th at 12 noon, formatted as a Lunch & Learn Zoom Session for black-owned firms in diverse sectors. Panelists for the session include Brad Owens, Capital Access Specialist for the Florida Small Business Development Center; Owen LaFave, Market President for Bank of Tampa; Flora Jackson, VP of Business Solutions at Grow Financial Federal Credit Union; and Latifa Jackson, One Community Business Navigator and CEO of Hurst Consulting. (Click here to register for the February 9th session).

In addition, One Community has raised more funding to continue its Business Navigator team to work one-on-one with as many businesses as possible. The Foundation for a Healthy St. Petersburg and the City of St. Petersburg are the largest funders of COVID relief services by One Community. Other supporters include Florida Blue Foundation and the Community Foundation of Tampa Bay.

To Get Help Applying for PPP

To get help applying for PPP funding, click here and fill in this brief survey. A One Community Business Navigator will follow up with you within 2 business days.